How Engie onboarded Onbrane to negotiate commercial papers

Engie will remain for Onbrane the first issuer of NEU CP that will have completed a whole transaction on the platform from negotiating through its trading floor to post-trade processes such as ISIN retrieval and descent into the back-office systems. In addition, authentication management was also directly managed by Engie via their SAML.

Onbrane offers different levels of onboarding, from simple negotiation tools to a fully digitized process.

Engie’s onboarding has been progressive, each level of onboarding having been validated and pursued with further integration until arriving today at optimal use of Onbrane.

I would like to describe the different steps here and share with you testimonies!

Let’s go!

Greenomy x Onbrane: Partnership to transform sustainable debt markets

Debt markets have a fundamental need for digitalization, efficiency and better integration across distinct groups of stakeholders. Onbrane and Greenomy make this happen on the ESG debt markets.

The ESG benefits for treasurers

The impact of environmental, social and governance (ESG) considerations on the treasury’s functions can no longer be ignored, as the treasurer’s main responsibilities become inevitably linked to ESG objectives. Today, many treasurers are integrating ESG into their debt financing processes to complement financial performance analysis. This transformation is gaining momentum.

Interview With Jim SHEA, 22 year Goldman veteran on the USCP Market

Presentation of the speaker Introduce yourself in a few words / what is your background? Jim Shea, 22 year Goldman veteran, traded fixed income securities lending and non-fin USCP, enjoys playing music and cycling and skiing. Can you tell us about an event that particularly marked you in your career? My first experience trading CP […]

Sustainability-linked Bonds explained

KPI-linked debts have led a radical development in the ESG debt markets. Sustainability-linked Commercial Paper and MTN were the first debt instruments to be issued by market participants. Green bonds, social bonds, sustainability bonds are “use-of-proceeds” debts, while sustainability-linked debts are general-purpose linked to the achievement of a sustainability target at the issuer level. It creates a direct financial incentive within the structure of the debt instrument.

Green Bonds explained in 5 minutes

This week, let’s focus on the green debts becoming mainstream in the debt capital markets. Green Bonds have been one of the key drivers of green finance. Challenges exist and opportunities are there to reallocate financial flows towards sustainable activities. Starting with what is a Green Bond, we will then present the current challenges and benefits for market players such as issuers and investors.

Why and How we add the Asset-Backed Commercial Papers on our platform

In terms of players, the ABCP market is a smaller market than the classic CP market, obviously with few vehicles issued to refinance a pool of assets. However, in terms of volume and particularly in USCPs, this market represents a good share of the total market. In fact, ABCP issuers often issue on multi-billion dollar programs.

This is why ABCP is an important part of the global Commercial Paper market.

Why and how do we add Sustainable Commercial Paper to Onbrane ?

Onbrane currently provides the debt capital markets with a multi-product negotiating platform across multiple markets. In 2020, we have received a strong demand from many players who wish to issue debt which is labeled as green, social and sustainability-linked. These labels are applicable to any debt product and at any maturity. They contribute to the growth of sustainable finance. Our ambition is to support all market players in their sustainable transformation.

Why and How we add the NeuMTN on our platform

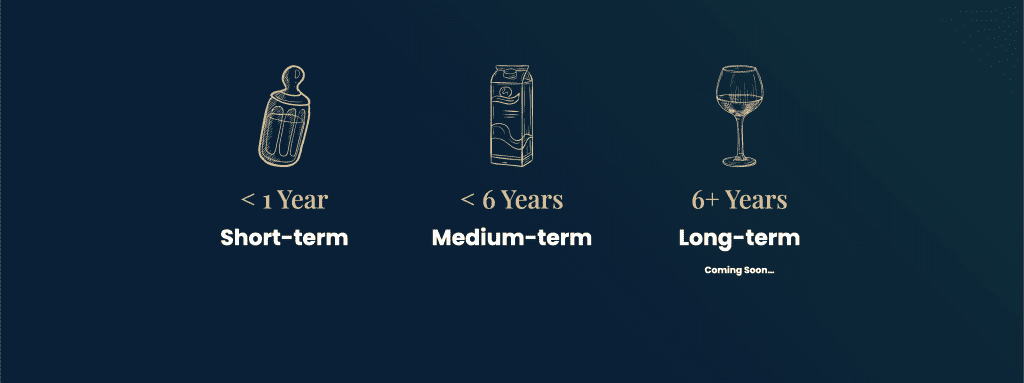

NeuMTNs are part of Onbrane’s genesis. The platform was implemented primarily to improve processes and simplify negotiations of the short- term debt. To do so we decided to begin with the French Commercial Paper market instruments (NeuCP and NeuMTN), that were created following the modernization of the French treasury bill market on May 31, 2016, led by the Banque de France. At first, in 2019, we wanted to focus on implementing the NeuCP on the platform as a Proof-of-Work of our project.

Why Bitcoin is an opportunity for the environment

Bitcoin is far from being the energy glutton portrayed in mainstream media. On the contrary, the Bitcoin ecosystem is accelerating the transition to renewable energy sources and decentralized economic development.