At the European Commission roundtable on September 11, 2024, industry leaders, including our CEO Pascal Lauffer, explored the pressing vulnerabilities within Europe’s CP/CD markets. What emerged was a consensus: a harmonized, streamlined approach is not just desirable but necessary.

Read Pascal’s post-event letter as he outlines suggested steps the industry must take to move forward:

“Thank you, Antoine, and the entire Commission team for organizing this event and inviting us.

I also want to take this opportunity to thank all the participants, with special mentions for a few of them.

First, I’d like to express my gratitude to Giles for his energy and the wealth of information he provided about the legacy processes in our industry – some of which, if I understood him correctly, date back to the Roman Empire (and here I thought only the railway industry carried idiosyncrasies from that era!). Giles certainly drove home the point about how outdated the Money Market infrastructure truly is.

Next, a special thanks to Nicolas for representing the issuers and reminding us that the Money Market exists to finance the real economy. He offered brilliant insights on how increasing efficiency in the market would contribute to changing the market itself – in a truly efficient Money Market, would we even need bilateral loans indeed?

I also want to thank Caroline. If I may, I felt the Commission was a bit harsh on Euroclear. Nearly four years ago, Euroclear (with Onbrane as a pilot) was the first to implement an API that allows platforms to obtain ISIN codes in real-time. Other clearers may have talked about it, but only Euroclear has delivered. Thanks to this innovation, billions in CPs are issued full STP on Onbrane every week – Now Giles has all his afternoons freed to do something more meaningful than running after ISIN codes, and his back-office doesn’t have to fix breaks 😉

I’m also grateful to Miroslaw for representing the 99% of the real economy that currently has no access to the Money Market. While we’ve discussed its inefficiencies, most of companies don’t have access to the Money Market and are often facing financing costs 10%+ higher than those with access. The Money Market remains a very exclusive club for the largest players.

I personally feel truly privileged to have been part of this discussion and to have been invited to contribute to what I believe is one of the most pressing challenges of our time. When I founded Onbrane in 2018, around the same time my twins were born, it was with a vision to help create a more sustainable and livable world for future generations. I believed that building a better world required a more efficient and innovative primary debt market to finance the enormous transformation ahead of us.

Six years later, it’s incredibly exciting to see so much interest, energy, and focus on improving the financing of the real economy and the market infrastructure that supports it. It’s almost difficult to keep up with all the significant reports on the subject – whether from Draghi, Noyer, or the FSB. These reports are all truly impressive in their depth and quality, and are also all consistent in their findings and recommendations. They all convey a strong sense of urgency – and with good reasons.

In March, Christine Lagarde stated, “One of the reasons why the Governing Council gave unanimous and strong support for the Capital Markets Union (CMU) to be rolled out” is Europe’s consistent loss of competitiveness over the past few decades.

As an example, in 1980, France’s GDP per capita was $12,835, while the United States stood at $12,598. Today, France’s GDP per capita is around $44,000, while the U.S. has surged to approximately $80,000. Imagine the vast loss of opportunity, wealth creation, and tax revenue over the decades – resources that could have transformed the education, healthcare, and pension systems, which are now deeply troubled, despite France’s recurring deficit and colossal debt.

This issue isn’t solely due to the lack of a Capital Markets Union. Europe is slow to innovate and slow to embrace technology. This is cultural and structural. As Mario Draghi pointed out a few days ago, the EU’s overly cautious regulatory approach toward tech companies stifles innovation.

In this context, I’d like to take a few more minutes of your time to reiterate my recommendations, if I may. I acknowledge this might seem self-serving, but I genuinely believe the following is the most effective way to get the job done.

Like everyone on the panels, I believe evolution – not revolution – is the way forward, and the best path to achieving visible results quickly. This principle is at the core of Onbrane’s approach.

Accordingly, I believe a light-touch approach from the Commission, supporting the successful initiatives (feeding the winners) while phasing out the less effective ones (starving the losers), would be the best way to accelerate the implementation of the CMU for the Money Market and enhance the overall market infrastructure.

But above all, I believe it’s time to fully embrace innovation and technology as catalysts for change. I therefore recommend leveraging a cutting-edge industry platform, as outlined below, to drive the gradual evolution toward a more unified and efficient Money Market.

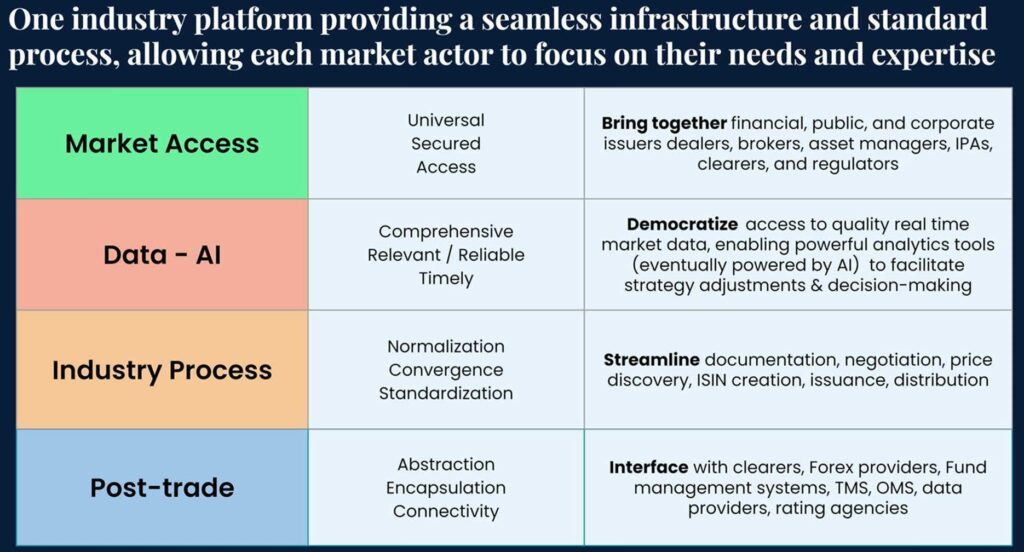

Market Access Layer: This is essential to lower entry barriers, create a more inclusive Money Market, and enable broader participation. It will also break down barriers between markets and countries by allowing all actors to ‘speak the same language.’

Data-AI Layer: This is critical not only for transparency but also to empower decision-making, which in turn facilitates transactions. An AI engine fed by comprehensive, relevant, reliable and real-time data will increasingly enable transactions that are currently unfeasible, particularly for smaller issuers or during stressed market conditions.

Industry Process Layer: Initially, this layer will normalize issuance processes across different markets and products. Over time, it will drive convergence and the emergence of market standards.

Post-Trade Layer: This layer abstracts and encapsulate legacy market infrastructures, ensuring they don’t hinder market actors from performing their roles efficiently.

As I stated on the panel, dealers are essential to the functioning of the Money Market. Their time will become increasingly valuable as an industry platform opens the door to a wave of new issuers, who will rely on dealers’ expertise to successfully enter the market.

What I’ve described is largely already operational on Onbrane. With nearly 70% of major Money Market dealers soon to be on the platform, leveraging Onbrane as the industry solution to drive the CMU for the Money Market is a logical step that would yield fast, tangible results. While it may seem self-serving, it’s important to note that Onbrane is the only operational platform designed to serve all industry participants, including the 99% currently excluded, with strong industry support from issuers, intermediaries, and asset managers.

My final recommendation is that, given the importance and urgency of the task, the industry unites to get the job done. The Commission can play a crucial role by initiating and supporting the process and by encouraging current market infrastructure providers to participate more actively than they do today.

In conclusion, the emergence of an industry platform would go a long way in achieving the Commission’s, ECB’s, and FSB’s objectives for the CMU and enhancing overall market infrastructure efficiency in the Money Market. It would also position Europe as a global leader in innovation in this field, as no such platform currently exists in the U.S. or Asian markets.

Thank you once again, and I look forward to continuing this journey together.”

Pascal, CEO at Onbrane