NEU CP

Your source of information about NeuCP, By Onbrane.

Definition

NEUCP, Negociable European Commercial Paper

A Negotiable EUropean Commercial Paper (NEU CP) is a short-term debt instrument issued by companies to raise funds generally for a period of up to one year. It was created in 2016 by the Banque de France as the result of a merger between former certificates of deposit (issued by financial institutions) and commercial papers (issued by non-financial corporations).

- Maturity: from 1 day to 1 year

- Currencies: Euro or any other currency authorized by applicable laws and regulations in force in France at the time of the issue

- Nominal amount: at least 150,000 euros (or the equivalent in foreign currency)

- Fixed or variable (indexed to $STR for example). The rate is freely set between the issuer and the investor. No coupon is paid between the issuing and the repayment. However, they may be issued at a price different from the nominal value or include a redemption premium.

- Law : French law

Sustainable NEUCP

Go Green !

In 2021, the Banque de France launched an ESG initiative to allow issuers to create ESG NEUCP program.

2 ESG debt formats exist with multiple labels

Use-of-Proceed format – the debt is used to finance in part or in full, new and/or existing eligible projects and assets that could contribute to environmental and/or social benefits:

- Green: finance solely environment projects and activities

- Social: finance socio-economic projects

- Sustainable: finance projects with both benefits

Some insightful articles

KPI-linked format – the debt is linked to the achievement or not of one or more KPI target(s). Variation mechanisms set the impact of these debts and some are more suitable for CPs:

- Step-up coupon

- Step-down Coupon

- Payment to third-party organizations (for instance, NGOs)

Analysis by Kleber

Make the NeuCP market more readable for corporate issuers

- the January 2023 analysis

- the December 2022 analysis

- the November 2022 analysis

- the October 2022 analysis

- the September 2022 analysis

- the August 2022 analysis

- the July 2022 analysis

- the June 2022 analysis

- the May 2022 analysis

- the April 2022 analysis

- the March 2022 analysis

- the February 2022 analysis

- the January 2022 analysis

- the December 2021 analysis

- the November 2021 analysis

- the October 2021 analysis

- the September 2021 analysis

- the August 2021 analysis

- the July 2021 analysis

- the June 2021 analysis

- the May 2021 analysis

- the April 2021 analysis

- the March 2021 analysis

- the February 2021 analysis

- the January 2021 analysis

Presentation of the actors

All of them enjoy market stability, liquidity and competitive financing terms.

Issuers

To finance their treasury needs (investments and current expenses), they issue commercial paper. Issuers are divided into 3 categories: bank and similar financial issuers, non-financial issuers and public issuers.

Dealers/Brokers

The intermediaries are in charge of the liquidity of the market. They conciliate issuer's financing need to investors investing interests by negotiating on both sides - they act as intermediaries in the negotiation of the characteristics of the issue. There are two types of intermediaries:

- Dealers which are banks. These are the main intermediaries. They can either buy the paper to resell it immediately to an investor or keep it in their book for later resale.

- Brokers connect the issuer and the investor in order to allow a transaction (brokerage).

They don't have the right to keep a Commercial Paper in their book.

Investors

NEU CP's investors are mainly money market funds that go through asset managers to make cash investments in NEU CPs. These funds are mostly French and European. Some corporates buy also NEU CPs to optimize their cash flow.

Issuing and Paying agent

The Issuing Paying Agent (IPA) collects the details of the transactions from the issuer, the dealer and the investor. The IPA is responsible of all the cash management for the transactions of their clients (issuance and repayments).

Ratings agencies

Rating agencies assess the risk of non-repayment by issuers in order to help negotiate the rate. The rating agency's report is on the program sent to the Banque de France. A company may not be rated but have a program that is.

Guarantors

They guarantee repayment If the issuer defaults. They intervene when an issuer is not rated by a rating agency. Less than 10% of transactions are carried out by issuers with guarantors.

Arrangers

Arrangers are market experts (banks, boutiques, etc.) who assist issuers mainly in setting up their NEU CP program or in creating their sustainable framework

Clearing House

Euroclear France is the central securities depository for the NEU CP market. Its role is divided into 2 parts: recording all transactions and managing payments. They deliver the ISIN codes that are allocated to each trade in the NEU CP market.

New CSD projects, such as ID2S, on the NEUCP were launched but have since disappeared

Banque de France

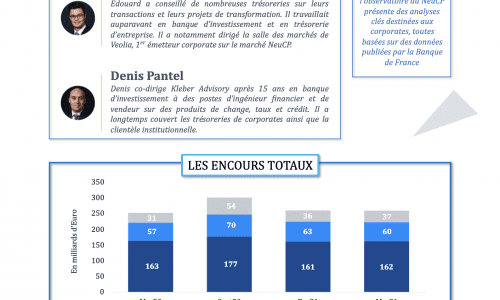

The Banque de France monitors the market and publishes statistics.

Process of creation of a NEU CP

1- Introduction to the market

To become active on the market, a new issuer must send its program to the Bank of France. This program is public and includes the company’s terms of issuance, such as its ratings, guarantors, paying agents, etc.

A new issuer is often accompanied by an arranger that helps better understand the market and take the first steps on it. This arranger can be an advisory firm or a market player (an issuing and paying agent or a dealer/broker).

2- Expression of need and negotiation

An issuer will contact the dealers / brokers of its choice indicating the amount he wishes to borrow and its rates. Intermediaries can either buy the paper to resell it to investors or keep it.

Depending on the liquidity of the market, the negotiations can be a lasting process, and each feature of a paper can be renegotiated.

Requests and offers may also come from investors or dealers / brokers who wish to buy NEU CP even if the issuer does not currently sell it.

3- NEUCP creation

The issuer will send a confirmation to his IPA. The latter will request an ISIN code to Euroclear, in order to identify the title.

Since the creation of Euroclear’s eNEUCP, a domiciliary may authorize a platform or a dealer to request an ISIN code on his behalf.

Different confirmations are also sent between the back offices of the various parties of the paper (investors, dealer, broker, etc)

And with Onbrane ?

Testimonies

The floor is open to market experts

Professional Associations

Where discussions take place

Since 1976, AFTE (Association Française des Trésoriers d’Entreprise) has been working for the development of corporate finance and the competitiveness of the French financial center. One of the most obvious features of the association is to represent the exclusive point of view of companies but in a non-corporatist way, by seeking to integrate the constraints of its partners, bankers in particular.

A 1901 law association, recognized by the authorities and market organizations, ACI France participates in the work of reflection, development and security concerning the monetary and financial markets, especially those over the counter. The AFTB is the interlocutor of the market authorities: Banque de France, AMF, FBF. It is close to other professional associations in the area.

L’Association Française des Professionnels des Titres (AFTI), established in 1990, aims to bring together professionals from banking and financial sector establishments concerned by activities on financial instruments. AFTI is a professional association governed by the law of July 1, 1901.

Our NEUCP Stories

Maybe soon on netflix

Discover other debt instruments

New markets, new opportunities

A Euro Commercial Paper (ECP) is a short-term negotiable debt security issued by a bank or corporation in the international money market to raise funds generally for a time period up to one year. It is denominated in a currency that differs from the domestic currency of the market where the paper is issued.

A Swedish commercial papers (SEK CP) is a short-term debt instrument issued by companies to raise funds generally for a period of up to one year.

A Pagares is a short-term debt instrument issued by companies to raise funds generally for a period of up to two years.

A Negotiable EUropean Medium Term Note (NEU MTN) is a medium-term negotiable debt security issued by a bank or corporation in the European money market to raise funds generally for a period of one to four years.

A euro medium-term note is a medium-term, flexible debt instrument that is traded and issued outside of the United States and Canada.