Understand the Onbrane platform in 5 points

All you need to know for today

01. We cover the main debt needs of corporates, public and financial institutions

Vanilla Debt

Sustainable Debt

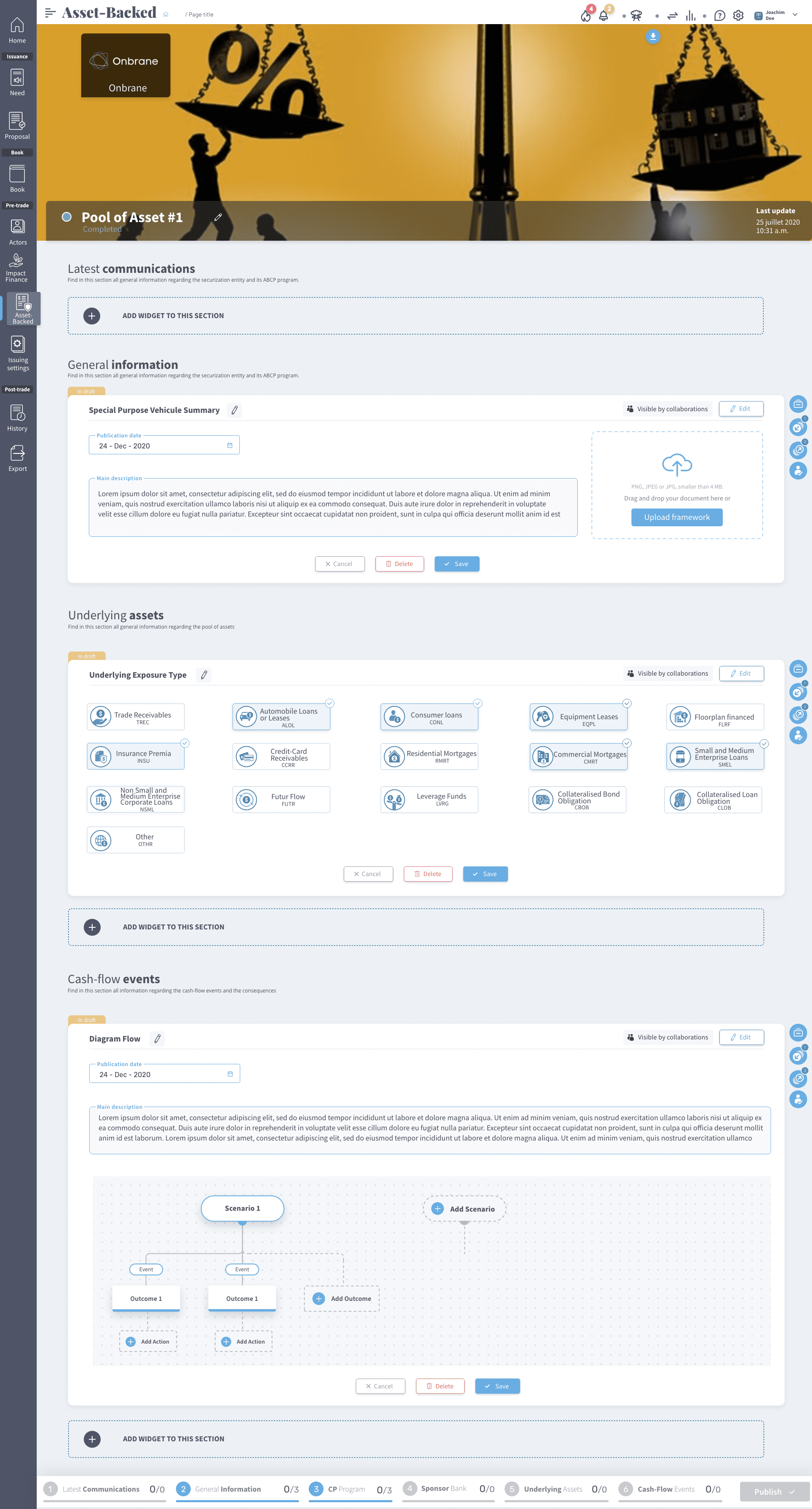

Asset-backed Debt

02. with standardized or semi-standardized debt products

Less than 1 year

From 1 to 7 years

A market where negotiations can be complex and time consuming. Our goal is to help this market achieve the simplicity and speed of a short term debt negotiation.

03. on a cutting-edge platform through every step of the process

-

1. PRE-NEGOTIATION

-

2. NEGOTIATION

-

3. POST-NEGOTIATION

-

4. DATA EXPLORATION

-

Activate easily your debt programs

Set up debt programs for all your debt instruments.

-

Add the counterparties of your choice

Explore and connect with all actors in one place.

-

Build and share all your frameworks

Use a powerful "PDF Killer" tool to present, interact and validate all information in your frameworks.

-

Communicate about your achievements

Link a negotiation with any of your frameworks and information with ease and clarity.

-

Negotiate on a bilateral platform

Select and trade with any counterparties (issuers, dealers, brokers and investors) separately and in complete discretion. We won't change that !

-

Standardized & Flexible negotiation

Reach a deal faster with a unique offer and counter-offer system. The terms of the agreement (amount, start date, maturity, rate, etc.) can be re-negotiated as you wish.

-

Retrieve the ISIN code in minutes

This is made possible thanks to our connections with clearers.

-

Send tickets to any software via API

Forget about manual entry, typing errors, and time-consuming reconciliations because all information can be sent to your internal software via API.

-

Automate the data flow to IPA and custodians

No more manual sendings as information is sent directly to your IPA or custodian

-

Manage your covenants (Coming soon)

Uploads your ESG or financial KPIs, see the impact on your convenants for every debts.

-

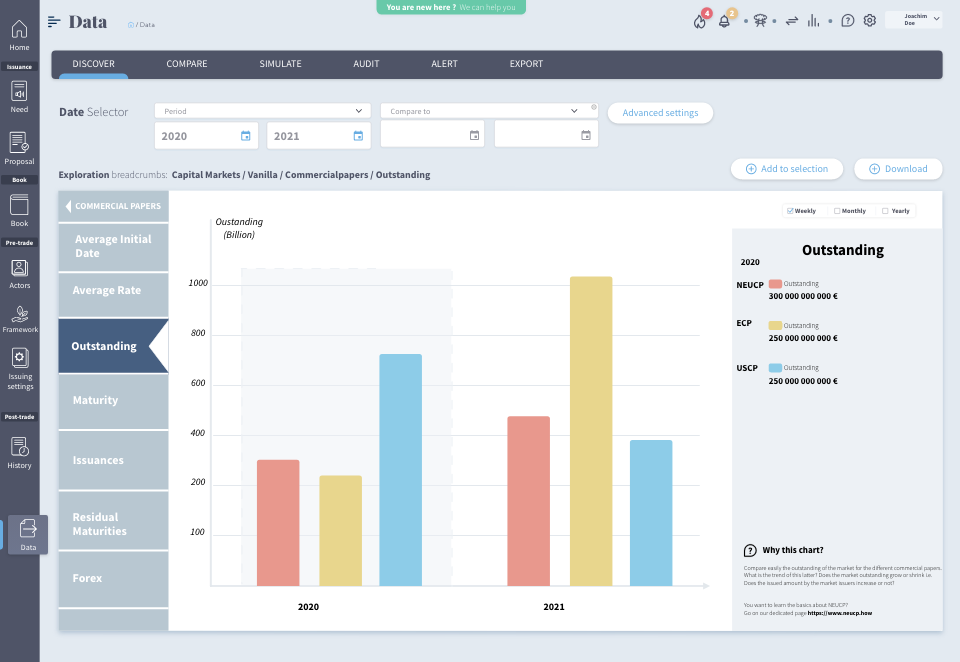

Access amazing data viz tools

Onbrane offers fully customizable dashboards to view a wide range of KPIs and market data.

-

Get critical insights on market activity

Compare your negotiation activity (rates, maturity, etc.) to the market and your peers in absolute confidentiality.

-

Export in one click all your data

Every action is recorded and accessible in new audit trails ensuring full regulatory compliance. Export your data in the best format to feed your reporting requirements.

04. for and connected to all actors of the debt ecosystem

Issuer

Dealer and Broker

Continue to bring your expertise and added value to the market. You work with the same rules as today, but with greater efficiency and security.

Investor

Paying Agent / Custodian

Clearer

Receive information from your customers directly from the platform. All in real-time and in a standardized way. A real help to speed up the pre-trade for your customers.

Rating agency

Connect instantly with all platform users to promote your expertise and make the best sense of their credit and ESG performance.

Arranger

Help your issuers with their debt programs and frameworks to promote their activities to investors.

05. Focused on the current pain points, but ready for the technologies of tomorrow.

Decentralized technologies

A blockchain natively allows market players to finally have a single data source, common to all. This new data recording structure has also proven its tremendous robustness over time.

We are aware of the hurdles still preventing rapid and massive adoption of blockchain technology. We have therefore designed a few stages implementation roadmap that takes into consideration the maturity of the ecosystem and the technology it requires.

Deep data management

The analysis and proper use of data is the key to optimization and efficiency in all industries.

The Onbrane platform, by bringing together all market participants in the same place, has the potential to gather a large amount of useful information concerning the securities created on the platform. This market data, combined with public data is a resource that will enable us to provide users with extremely useful tools to manage their business.

Our solution 4 pillars

The 5 things you need to remember before leaving

Beyond the difficulties for companies to finance themselves in the short term, COVID 19 has highlighted the global Commercial Paper market’s sensitive points: lack of digitalization, lack of security, and various liquidities. Onbrane’s vocation is to respond to this and become an essential communication tool in managing the next crisis.

A virtual place for all debt actors

Onbrane is an OTC platform designed with and for issuers, intermediaries and investors. Unlike its competitors, Onbrane caters to every market actor, connects liquidity pools globally and leverages existing ecosystems to issue potentially any kind of debt.

A Full STP process

Full STP (Straight-through processing) allows fast and smooth information circulation – no manual errors; no time wasted. The Onbrane platform natively has the potential to be interconnected with any third-party software.

Leverage Data

Behind all the talk about the importance of data lies a rather simplistic truth: it is essential for market players to know what is happening to make informed decisions. Actors of financial markets should always be in a know about the opportunities, in terms of markets, currencies, maturity, rates…

Growth of your ESG capabilities

ESG integration in the issuance of debt products is generally associated with much confusion about how to proceed in practice. Integrating ESG variations into debt products is becoming increasingly trendy. That's why Onbrane wants to help issuers and investors explore the world of possibilities for linking ESG KPIs to debt products.

Zoom on some features

That's just a teaser

Onbrane "PDF Killer" : The best way to present and communicate about debt projects with investors.

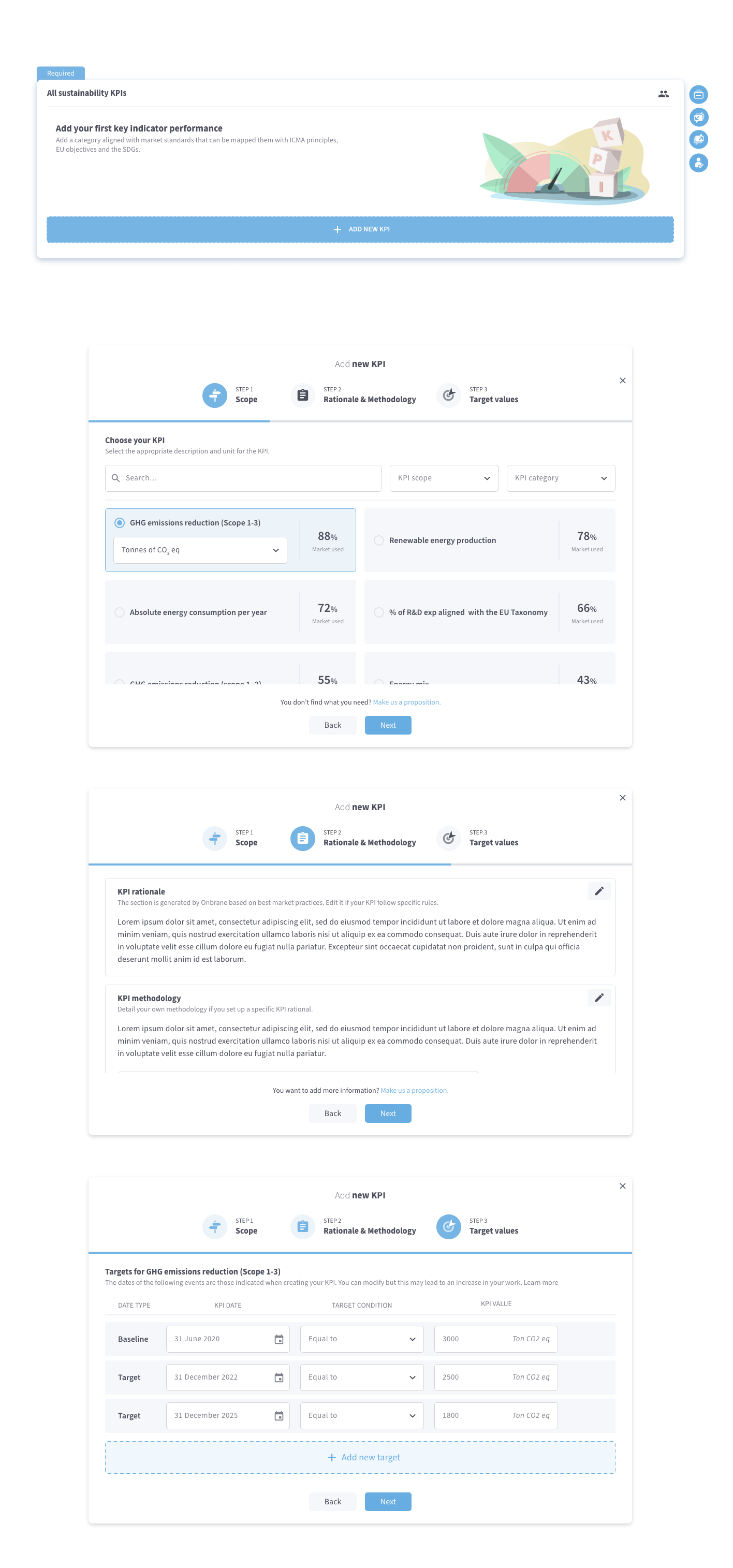

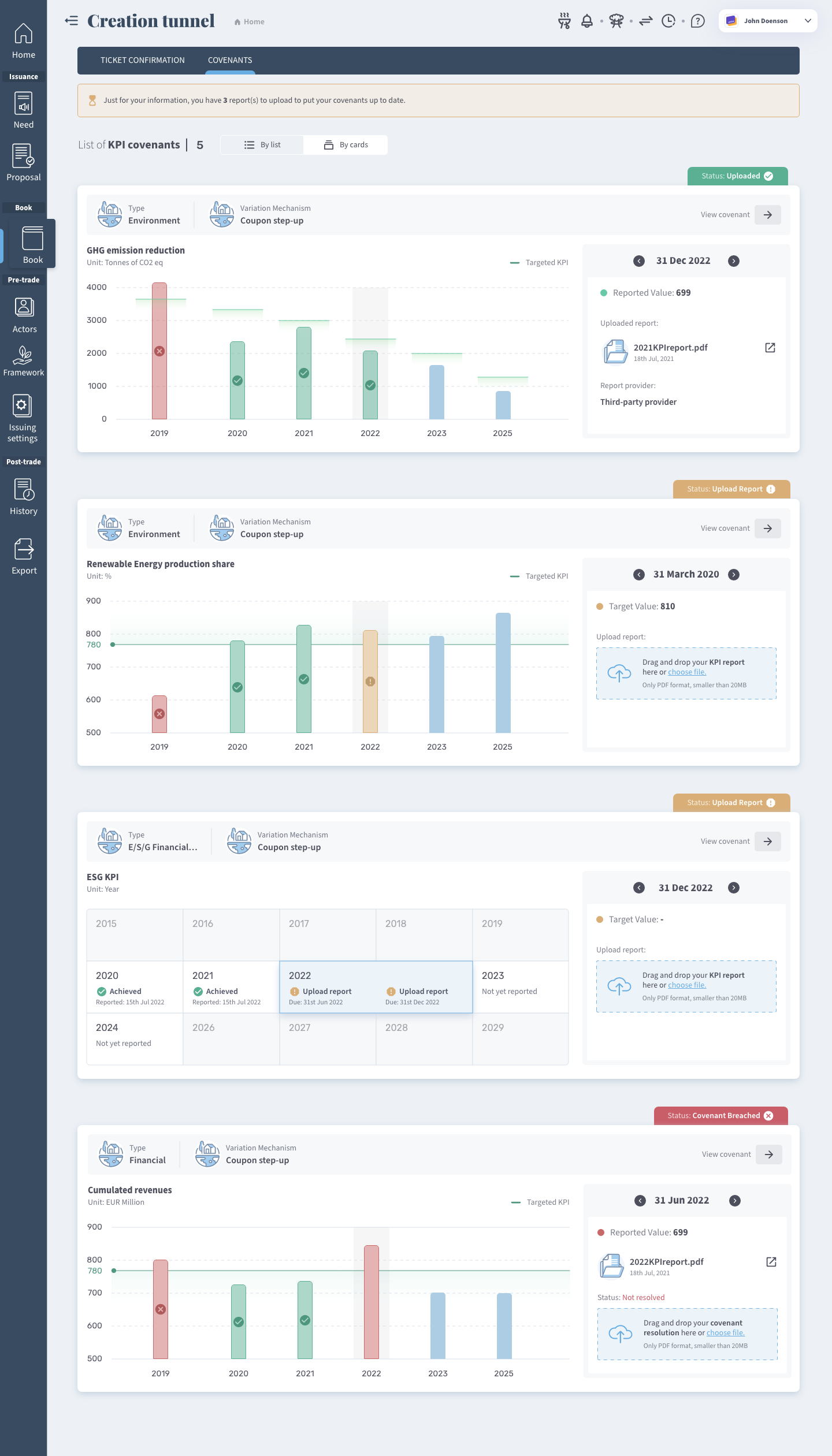

Standardised KPI Tracker:

Choose from market’s favorite ESG and financial KPIs to add them to your framework and debt products.

On Onbrane, you can add all the KPIs you want to use in your covenants on the framework page. The platform provides you with a list of standardized KPIs that helps you make your documentation comparable to the market.

Already have a debt programme with covenants? You can add it on Onbrane and continue managing your program and related covenants in a digital streamlined environment with your counterparts.

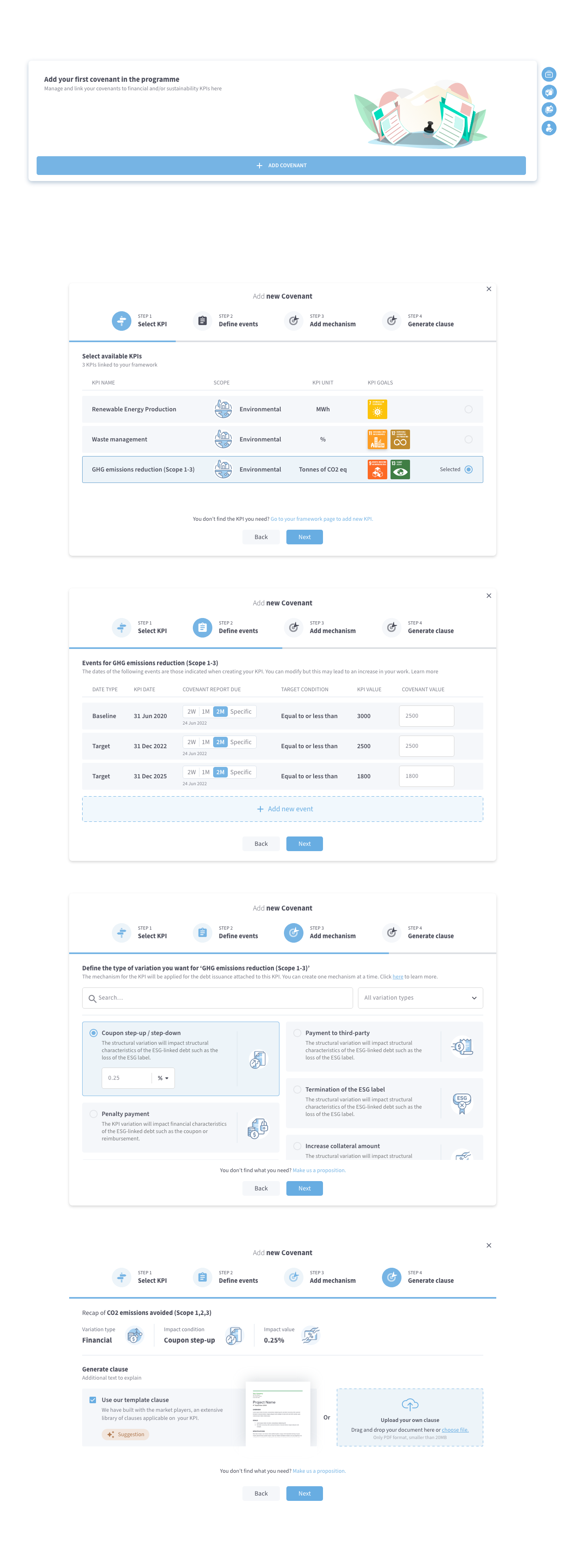

Convenant mechanism builder:

Create, attach and see covenants events and mechanism with KPIs and debt products.

(Coming soon)

On Onbrane, issuers can define covenant by debt instrument or programme. Each covenant has its reporting schedule, condition, and mechanisms.

The platform has a list of standardised mechanisms that apply when not complying with the covenant (coupon step-up, redemption, loss of an ESG label, etc). We also indicate which mechanisms are most used by other market actors.

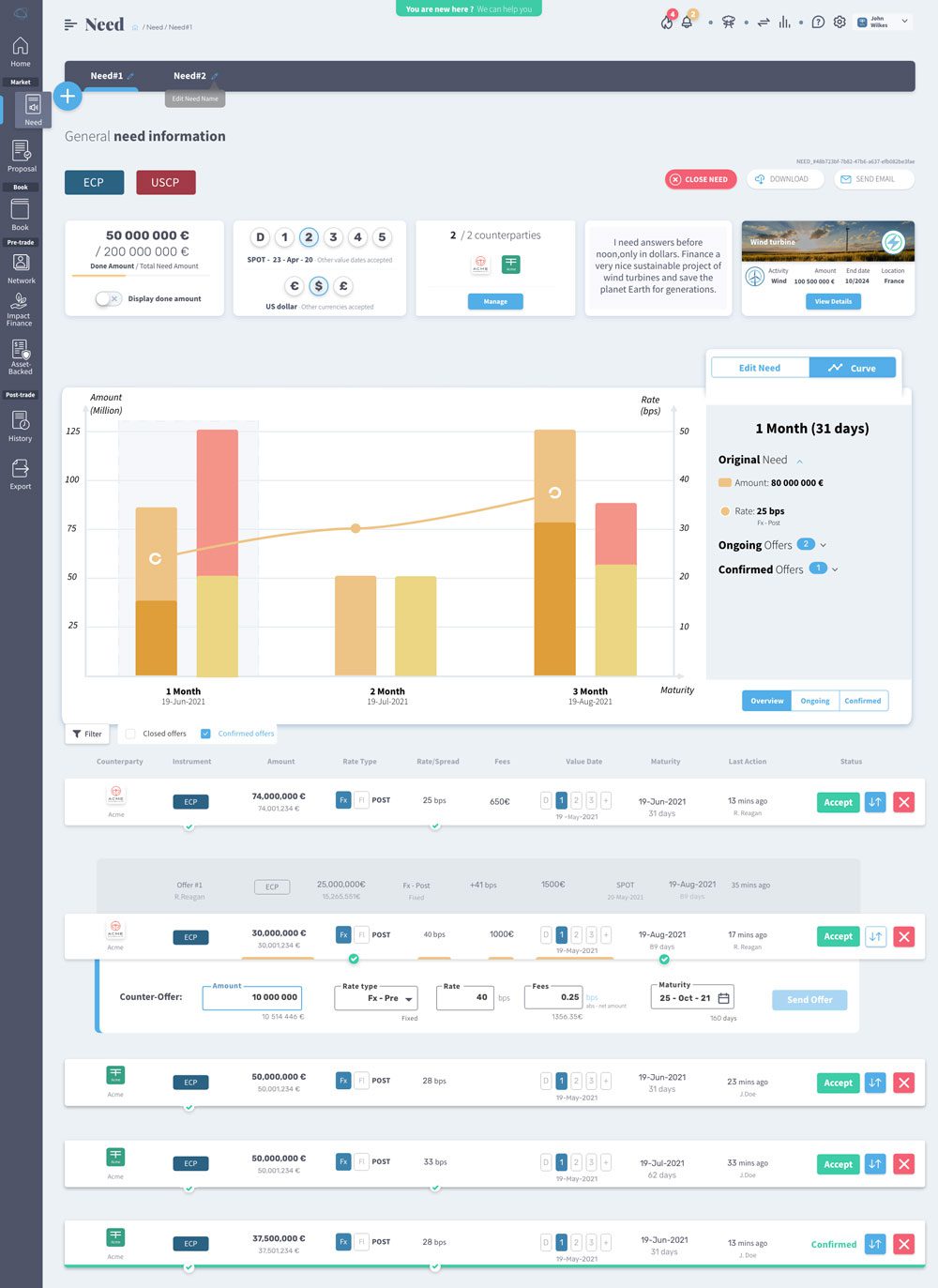

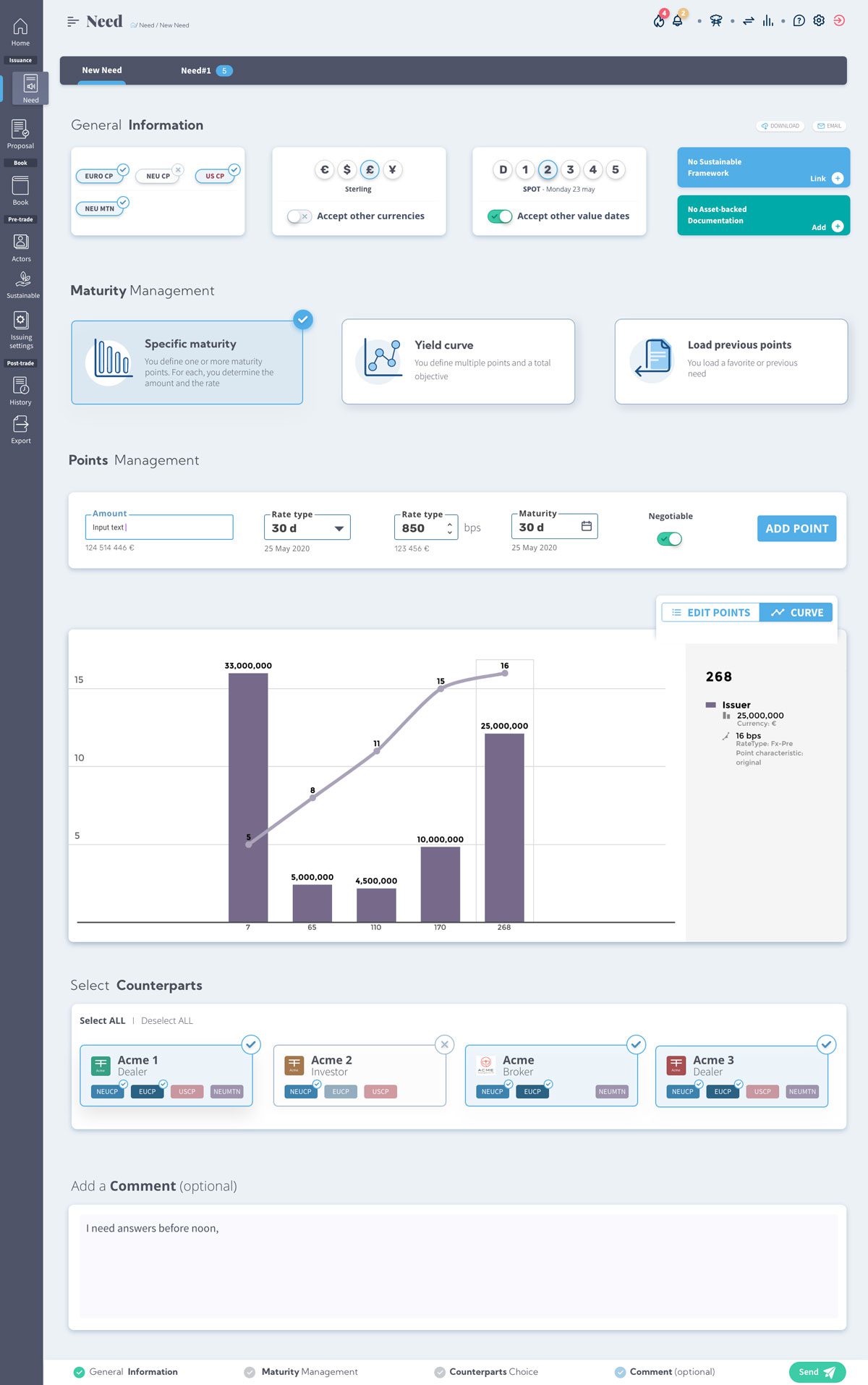

Need : Express your financing requierements of the day

As an issuer, build easilly your need curve and send it to the counterparties of your choice in order to get your financing.

Sending a Need to any counterparty is not binding ! It is just the expression of your need of the day.

Negotiation : Flexible, fast and under your control.

Negotiate on the different needs terms of an issuance. Send offers and counter-offers to your counterparties until you have an agreement !

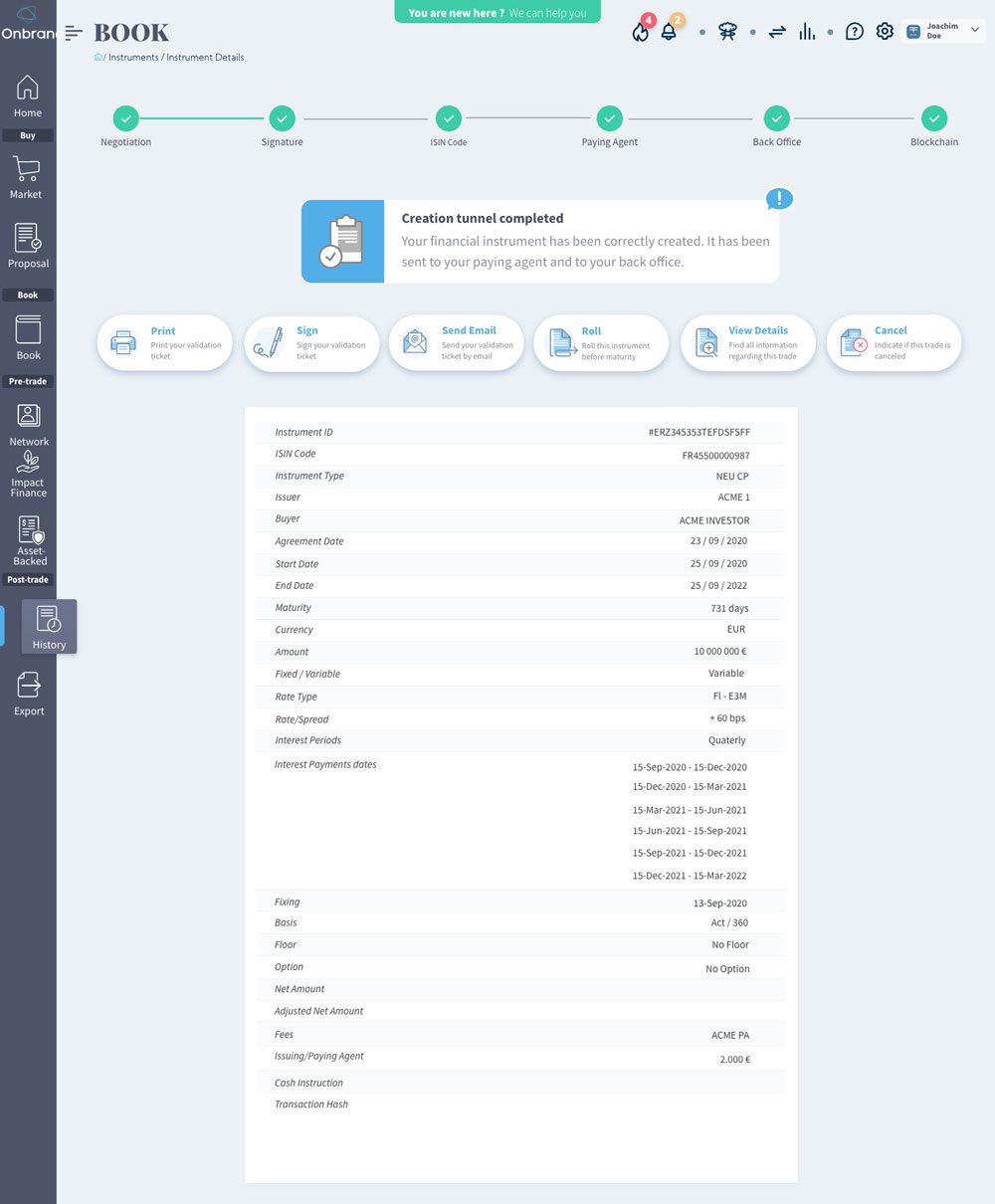

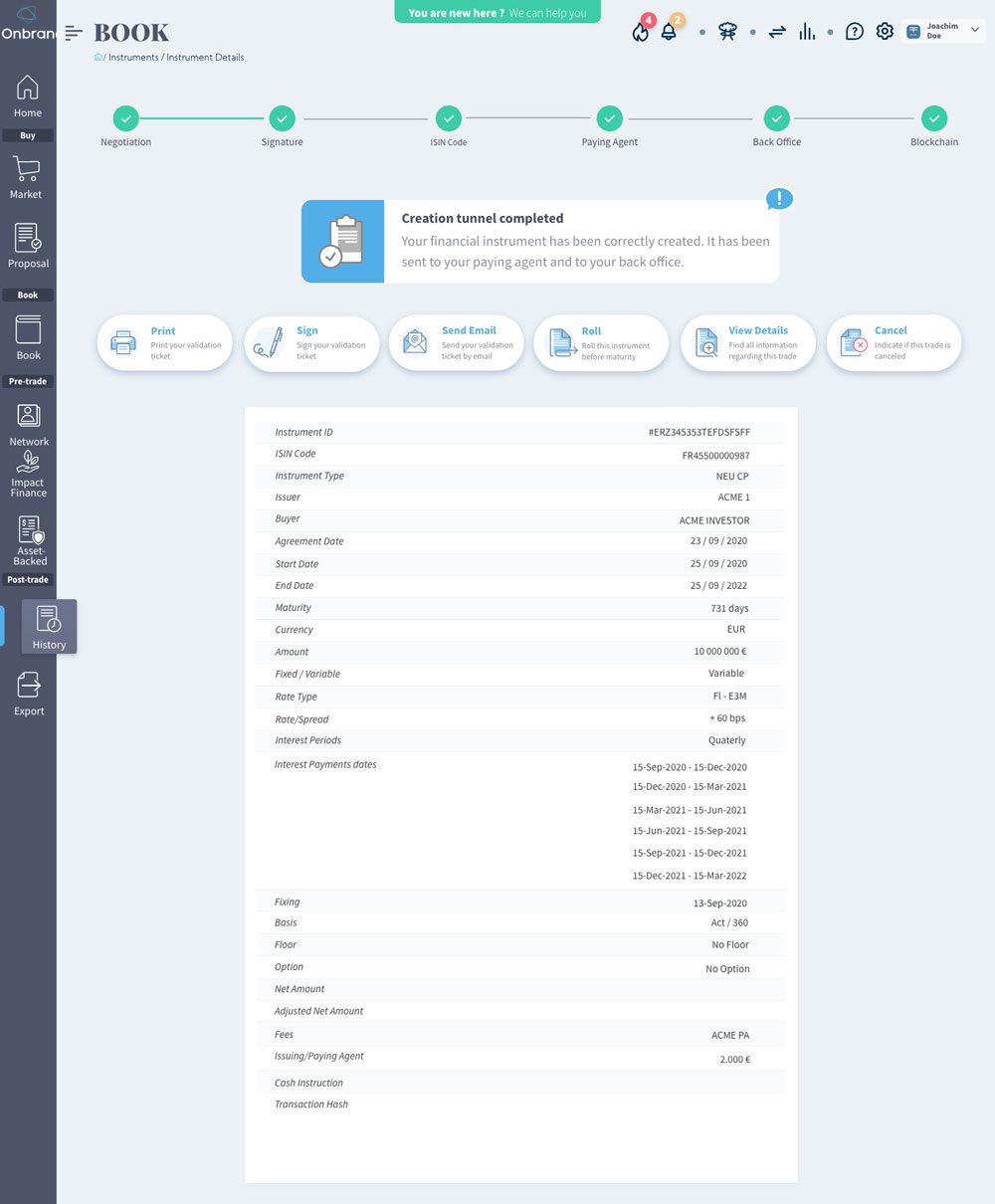

Creation funnel : Full automation where you need it the most.

A debt creation consists of a series of steps (signature, recovery of the ISIN code, send to the IPA, link to back-office software …). Onbrane allows you to choose the steps you want to automate, thanks to its multitude of APIs. This tunnel adapts to your current processes while allowing you to streamline them.

Debt covenant monitoring:

Stay on top of your commitments & comply with covenants at ease.

(Coming soon)

Onbrane allows you to follow all the past and future events related to your covenants on each financial instrument.

What’s more, the Onbrane platform helps you stay on top of the important events (for instance, when the KPI report is due). You can configure custom notifications and get alerted prior to the due date.

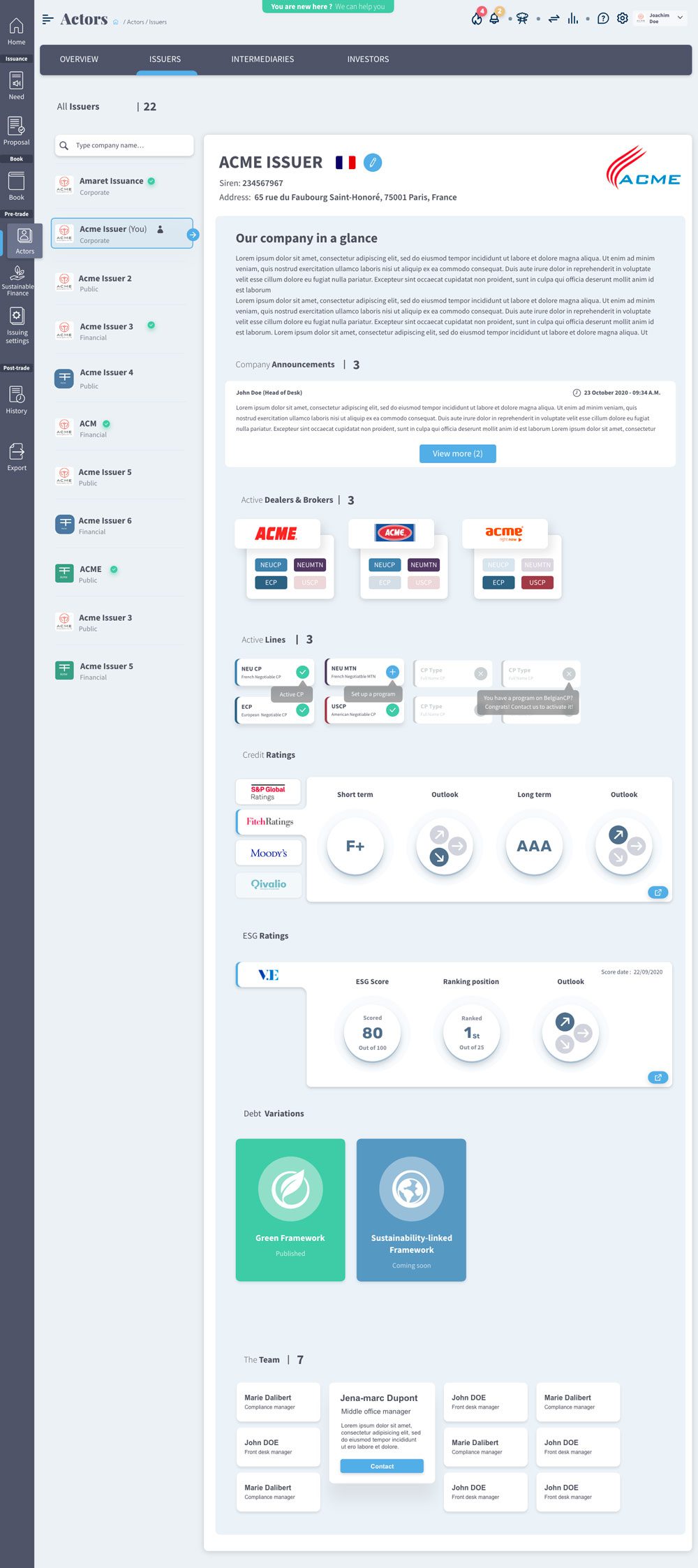

Actor page : Manage your network

See all the Onbrane community (Issuers, Intermediaries and investors) and con-nect to them via the instrument of your choice. This is the first step of many negotiations !

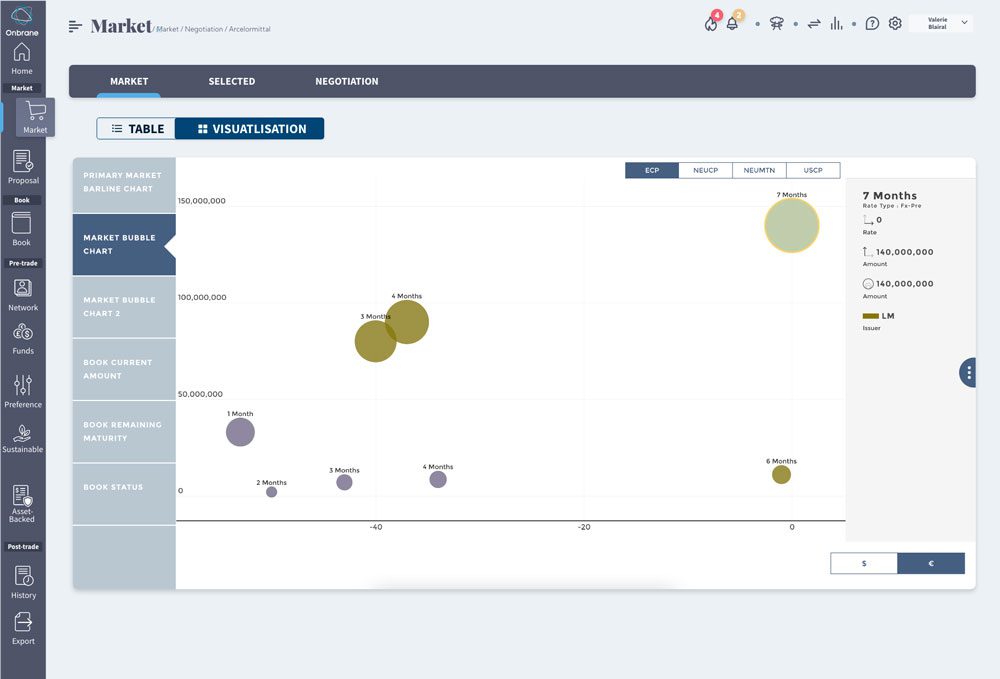

Data exploration : All you need to know, displayed wit the best UX possible.

The platform is empowered with impactful and optimized data vizualisation to have a sharp eye on the market.

They speak about Onbrane

Impressions of our users

Your most asked questions

Our answers make us unique

Intermediaries play an essential role. They guarantee fluidity, liquidity and ensure market development :

– Intermediaries can seek this liquidity or even hold the security for a period of time.

– They attract new issuers and investors.

– The time savings offered by intermediaries are considerable. While an issuer only deals with 4 or 5 intermediaries, a dealer or broker has more than 200 investors behind it. Knowing investors, their interests and their capacity require expertise and time that not all issuers necessarily have.

– They advise and negotiate the most adapted price.

The answer is quite simple: All currencies!

Thanks to our connection to the current clearers, you can now trade in the currency of your choice (EUR, USD, GBP, AUD, NZD, CNY, SEK, etc.).

In theoretical physics, Branes are dynamic objects that propagate in space-time according to the rules of quantum mechanics. Our project is based on a constantly evolving ecosystem that depends on technological progress; ultimately, it’s mostly because we’re geeks, and it absolutely rocks !

Yes, and we are not jealous. Thanks to our connection with the current ecosystem (Clearers, Paying agents…), buying debt on Onbrane and selling it elsewhere is possible. Our solution completes the current liquidity pool.

We propose a simple, tailored-made onboarding to avoid project risks and quickly add you to the platform. We do not change your team’s activities: we digitize them.

Of course, yes ! This is how the market works today: you can choose your counterparties (Issuers, Dealers, Brokers & Investors) one by one and negotiate with them in full discretion. We will not change that !

No, you choose with whom you want to negotiate. And your price is revealed to the counterparts of your choice.

No ! Forget about manual entries, typing errors, fastidious reconciliation, or time-wasting; all the information can be sent via API to your internal software.