A virtual place for all debt actors

Virtualization of your Process

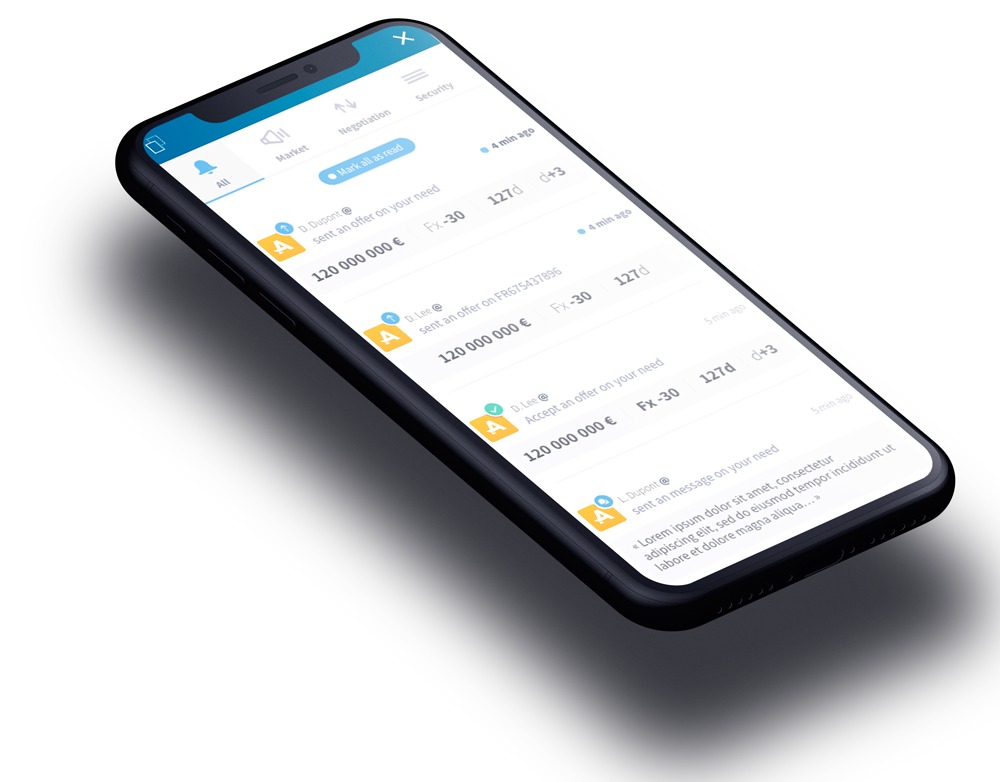

Beyond a sanitary measure that can be reused, the home office is a social evolution that will only increase in the future. However, the financial world is not yet fully equipped for this because these new means of communication must meet market standards, namely :

Security

Thanks to the application bricks of Amazon Web Service (such as AWS Cognito), Onbrane has the latest advances in terms of connection. Many authentication systems are available for our users (double factor, SAML...).

Integration

Onbrane can be connected to third party software via API, in order to be able to communicate orders to the middles and back office instantaneously and without error. We also have encrypted lines for SWIFT exchanges.

Traceability

All actions on Onbrane are saved and available to our users, offering new audit trails and full compliance. Logs are also saved on blockchain to guarantee their persistence.

Source of liquidity

with standardized or semi-standardized debt products

The debt market is made up of many sub-markets, including Commercial Papers, itself sub-divided into domestic markets such as the NEU CP, EURO CP, US CP… However, all these markets respond to the same need: to finance themselves or to invest their cash under the best possible conditions. Codes and practices are quite similar from one market to another. Limiting oneself to just one of them causes dependency that can lead to higher prices or even a lack of liquidity.

On Onbrane, a type of commercial paper is only one characteristic of a paper, just like its amount or rate. The platform is designed to animate the debt market in the broadest sense, so you can arbitrate between the available products with just a few clicks.

We add new debt products as quickly as possible, and above all we do it with the community, to find the most strategic pockets.

From 1 to 6 years

A market where negotiations can be complex and time consuming. Our goal is to help this market achieve the simplicity and speed of a short term debt negotiation.

Over 6 years

Coming soon…

Based on a Ecosystem

Issuer, Dealer, Broker, Investors, IPA, CLearer, rating agency...

The debt market is made up of many players with diverse roles. Depending on the context, the roles of each may vary in intensity. When markets contract, intermediaries participate in the effort to sell debt and make transactions more fluid. When the mood is one of caution, AMs may withdraw to the benefit of investors with more risky profiles. When liquidity disappears, central banks can take over.

In the crisis conditions we have experienced, it is obvious that CPs must be able to be bought by any investor and that intermediaries must participate in the search for a buyer. And yet some, now on CP, are talking about cutting out certain intermediaries and creating their own closed payment-delivery system . Onbrane is the opposite of that, proposing a 100% open system that allows you to buy on its platform and resell by other means. We stimulate the work of intermediaries through our functionalities and our business plan is not in competition with theirs.