Your one-stop shop ESG+ solution

to promote, negotiate and issue ESG debts

The most advanced ESG offering with one of the best user experience

in the debt capital markets

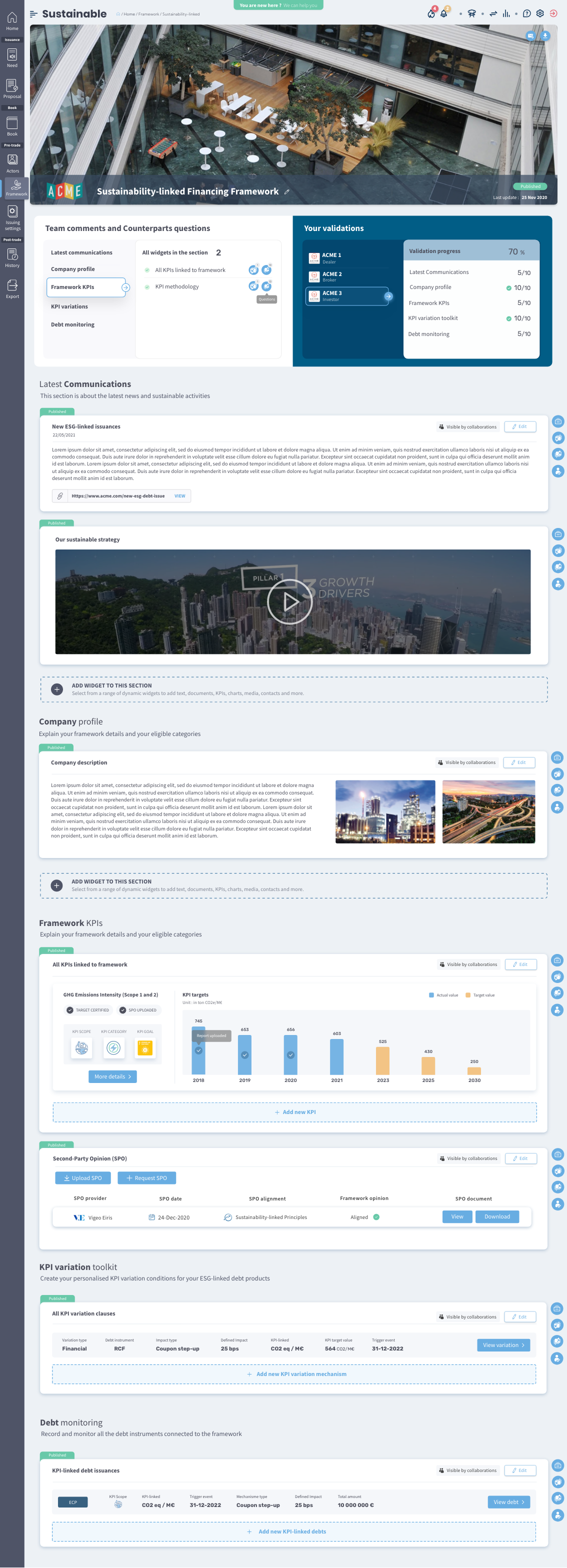

Framework builder : Add, update and promote your framework in an interactive and transparent manner with the investor community… and beyond.

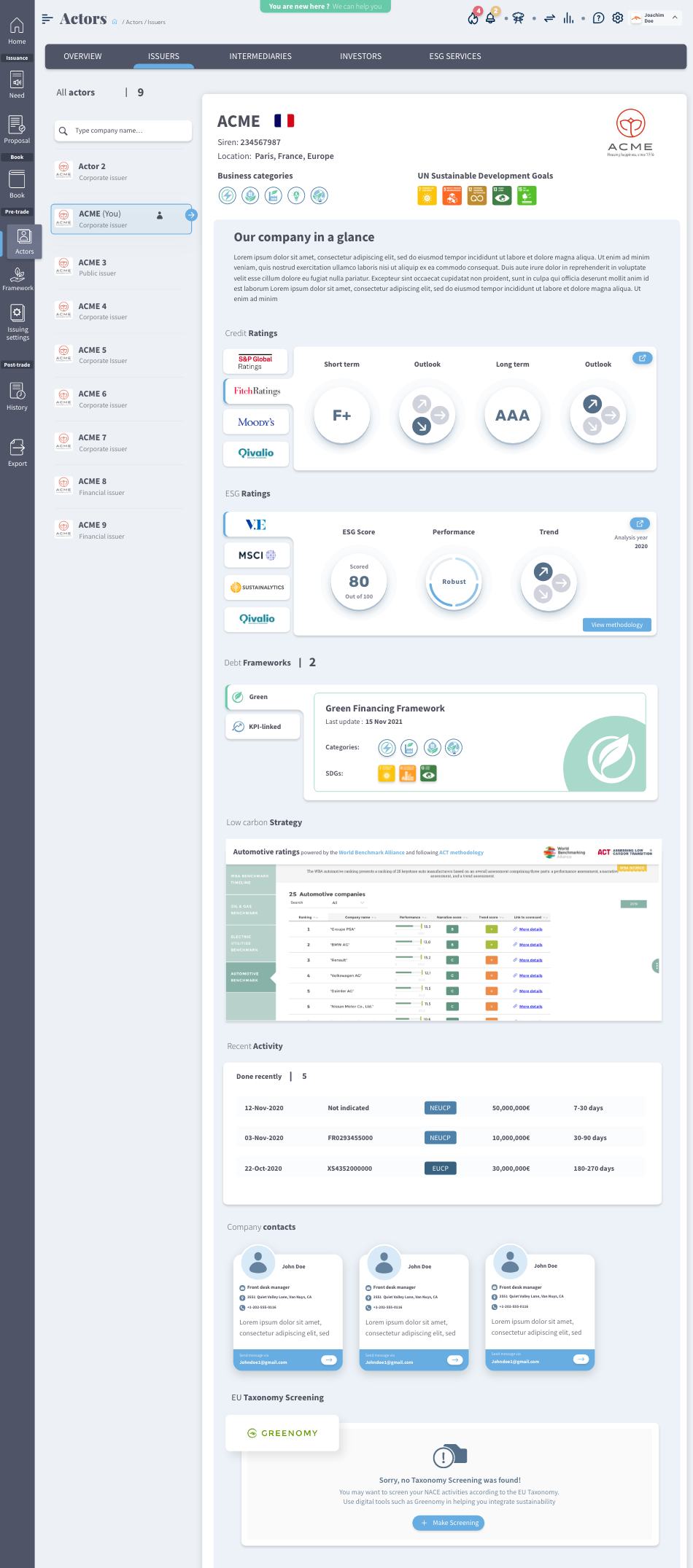

We enable the creation of ICMA-compliant ESG debt frameworks between your teams and all involved parties (arrangers, SPO, investors…). Share effectively and communicate broadly on it (Roadshow, online presence, etc).

Use-of-proceeds frameworks

KPI-linked framework

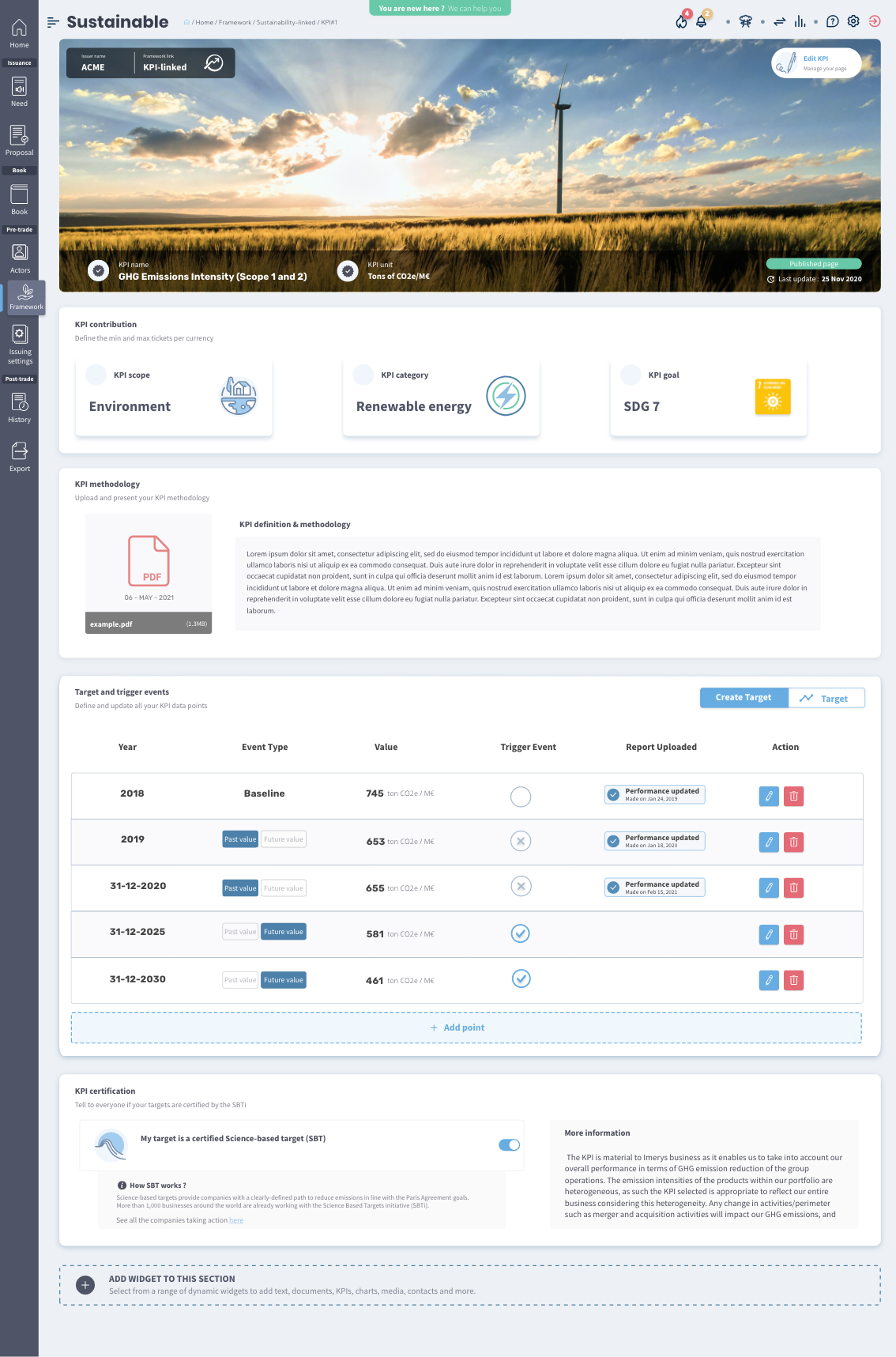

KPI tracker : Add your chosen ESG KPIs to your framework and broadcast your progress to your investors and everyone else who care about how you are doing as an ESG responsible company.

Data Intelligence services : Stay on top of a wide range of data from the ESG ecosystem concerning your framework, KPIs and company reports.

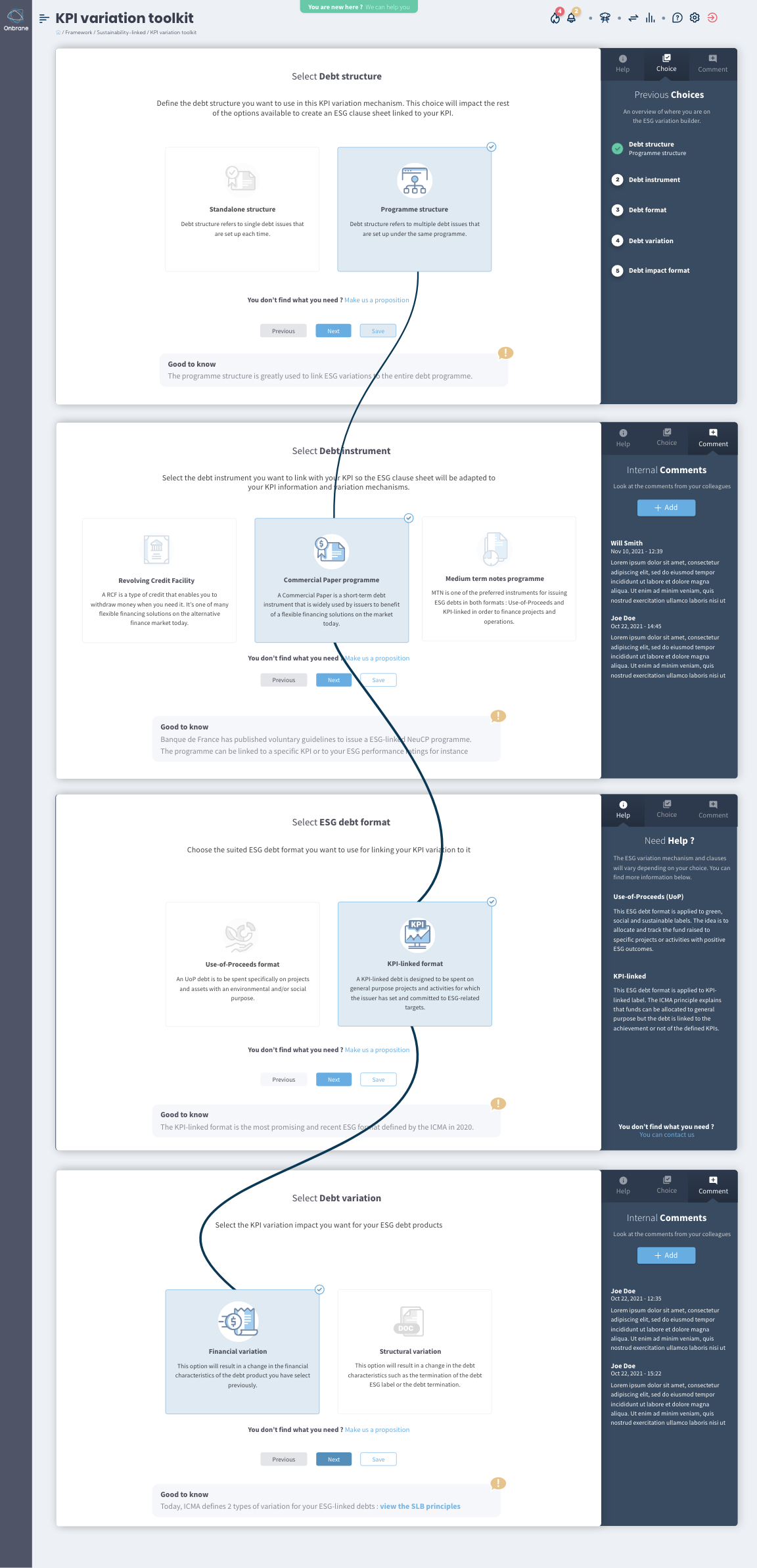

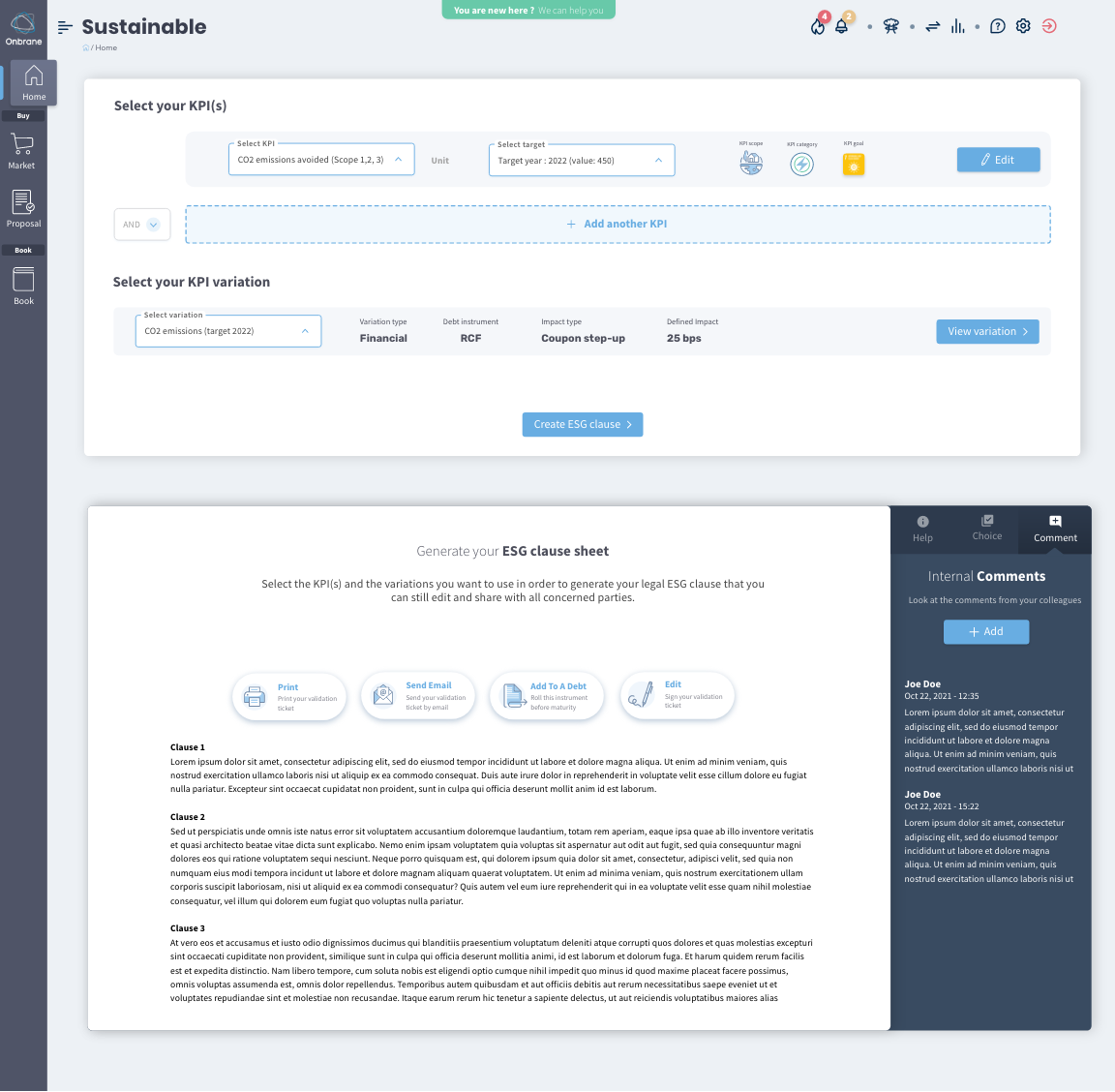

KPI variation toolkit : Explore a world of possibilities to link your ESG KPIs with your debt products thanks to a tool designed for and with the market

Legal clause generator : Generate automatically your ESG clause sheet setting out your KPI variation link by using our legal tech module.

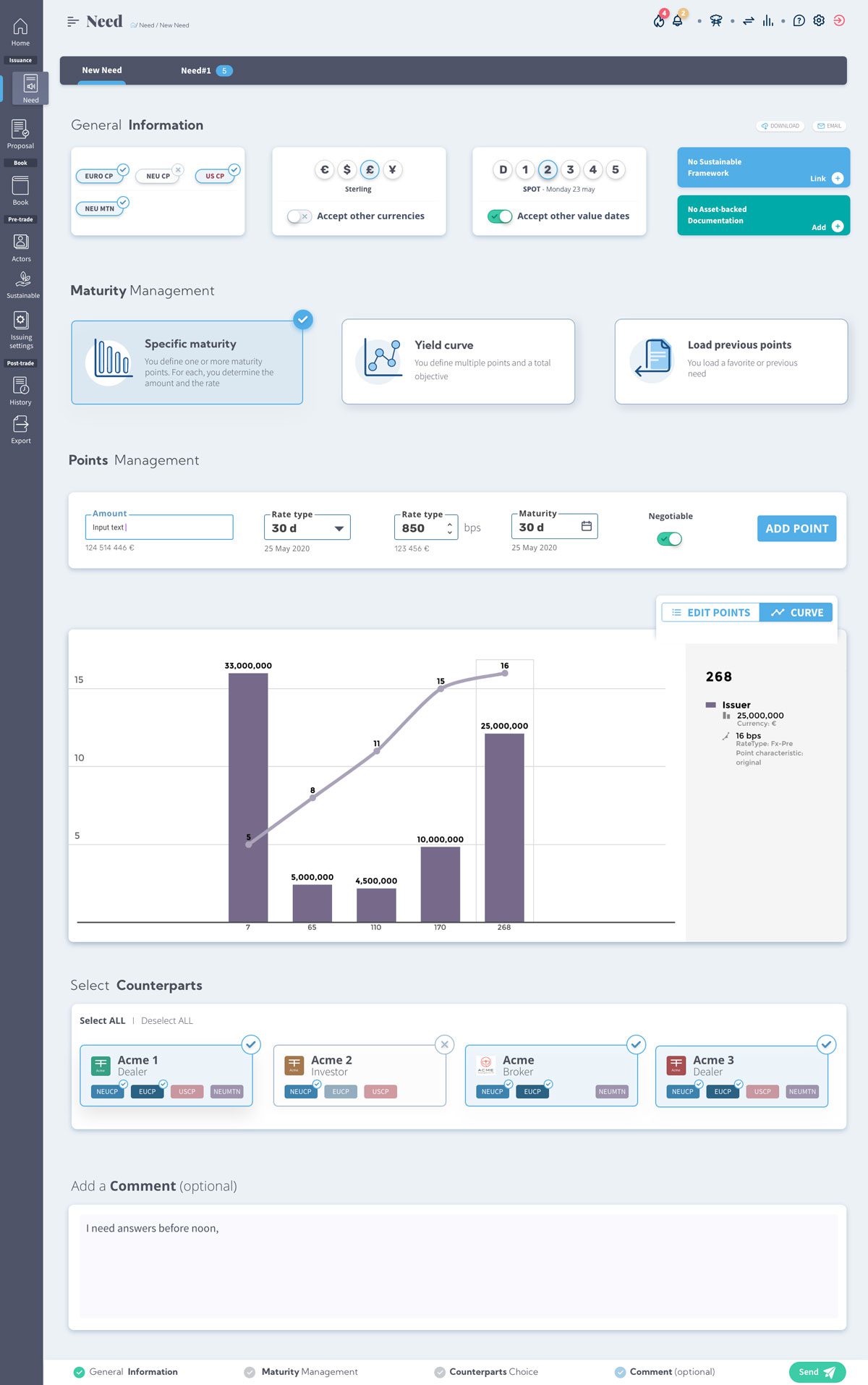

Debt negotiation and issuance : Benefit from the leading and most innovative debt negotiation and issuance platform available on the market

We are the most comprehensive primary debt market offering for issuers, dealers, brokers, and asset managers globally. Onbrane has one of the best user experience in capital markets. It has now also the most advanced ESG offering, covering the entire life cycle of ESG products from framework definition to debt issuance to KPI tracking.

Market challenges

Several challenges to be addressed in these markets.

Strong demand for transparency

Today, sustainable debt may suffer from greenwashing and limited credibility on the debt markets. Transparency is essential for everything and all stakeholders in the market are calling for greater disclosure and accountability on the use of funds and impacts.

No reporting harmonization

Reporting is at the heart of what makes a sustainable debt instrument. However, there is no obligation or strict harmonization for impact reporting. The market standards established by ICMA are only recommendations. We are still at the beginning of a slowly emerging standardisation at the European level.

Time wasted in manual processes

Many processes are needed for sustainable debt instruments and standards are constantly evolving. There is no single platform enabling everything to be done in one place. From issuing a debt security to impact reporting and collaborating with key market players.

Limited communication workflow

Many different interactions are required to build up the credibility and accountability of issuers. They may seek structuring advice from banks, seek advice from a second party to verify the alignment of their framework, have independent verification by auditors, and communicate your results to their investors.

Knowledge asymmetry and information gap

Sustainable debt markets have been driven by strong growth and interest from investors and issuers since 2015. Each year, many market developments are taking place. The gap in knowledge constitutes a barrier to entry into these markets, according to the Investor survey conducted by the Climate Bond Initiative (CBI).

We are bringing simplicity and efficiency in the sustainable debt markets.

Our ambitions

Build a better, more sustainable

primary debt market

Read More

All our articles about sustainable finance